Payroll is important for every company. It ensures that employees are paid on time. When a company operates in many countries, payroll can be complex. Each country has its own rules for payroll. Moving payroll to cloud HR can help. But, how do you map multi-country payroll rules to cloud HR? Let’s find out.

Understanding Multi-Country Payroll

Each country has different payroll rules. These rules can include taxes, social security, and benefits. It is important to follow these rules. Not following them can result in fines. So, understanding these rules is the first step.

Common Payroll Rules Across Countries

- Income tax deductions

- Social security contributions

- Health insurance deductions

- Retirement savings contributions

These rules vary from country to country. But, they are common in many places. Knowing these rules helps in mapping payroll to cloud HR.

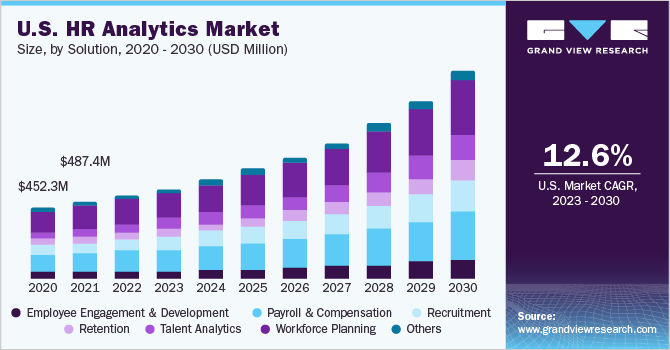

Credit: www.grandviewresearch.com

Benefits of Cloud HR

Cloud HR offers many benefits. It can save time and reduce errors. Here are some benefits:

- Access from anywhere

- Automatic updates

- Data security

- Easy integration with other systems

These benefits make cloud HR a good choice for companies with multi-country operations.

Credit: www.skuad.io

Steps to Map Multi-Country Payroll Rules to Cloud HR

1. Understand Local Payroll Rules

The first step is to understand local payroll rules. Research the rules for each country. Make a list of these rules. This will be your guide.

2. Choose A Cloud Hr System

Choose a cloud HR system that supports multi-country payroll. Look for features like:

- Compliance with local laws

- Multi-language support

- Multi-currency support

These features will help in managing payroll for different countries.

3. Configure Payroll Rules

Next, configure the payroll rules in the cloud HR system. Use the list of local payroll rules you made earlier. Enter these rules into the system. This step ensures that the system follows local laws.

4. Test The System

After configuring the rules, test the system. Run a few payroll cycles. Check if the system calculates payroll correctly. Fix any issues that come up. Testing is important to ensure accuracy.

5. Train Employees

Train your HR team to use the new system. They should know how to enter data and run payroll. Training helps in smooth operation.

Challenges and Solutions

Mapping multi-country payroll rules to cloud HR can have challenges. Here are some common challenges and solutions:

1. Language Barriers

Challenge: Different countries speak different languages.

Solution: Choose a cloud HR system with multi-language support. Train employees in the local language.

2. Currency Differences

Challenge: Different countries use different currencies.

Solution: Use a system that supports multi-currency. Ensure accurate currency conversion.

3. Compliance With Local Laws

Challenge: Each country has its own payroll laws.

Solution: Stay updated with local laws. Use a cloud HR system that updates automatically. Regularly review and update payroll rules.

Frequently Asked Questions

What Is Multi-country Payroll?

Multi-country payroll is the process of managing payroll in multiple countries. It ensures compliance with local laws.

Why Map Payroll Rules To Cloud Hr?

Mapping payroll rules to Cloud HR centralizes payroll management. It improves accuracy and compliance.

How To Handle Different Tax Laws In Cloud Hr?

Configure the Cloud HR system to meet each country’s tax laws. Use local expertise for accuracy.

Can Cloud Hr Manage Multiple Currencies?

Yes, Cloud HR systems can handle multiple currencies. It simplifies payroll processing across countries.

Conclusion

Mapping multi-country payroll rules to cloud HR is essential. It ensures compliance with local laws. It also improves efficiency and accuracy. Follow the steps mentioned above. Understand local payroll rules. Choose the right cloud HR system. Configure, test, and train employees. Overcome challenges with the right solutions. This way, you can successfully manage multi-country payroll in cloud HR.

Thank you for reading. We hope this article helps you map multi-country payroll rules to cloud HR. For more information, keep learning and stay updated.