Why is Bangladesh’s startup ecosystem thriving in 2025? The Bangladesh startup ecosystem has evolved dramatically, attracting significant venture capital investment and government support. Tech Startups in Bangladesh are fueling economic growth, with over 1.5 million jobs created. Furthermore, the ecosystem now supports over 1,200+ active startups across various sectors, making it one of South Asia’s most dynamic innovation hubs. Tech Startups in Bangladesh are thriving due to government support and increasing venture capital, as seen in companies like Pathao and bKash.

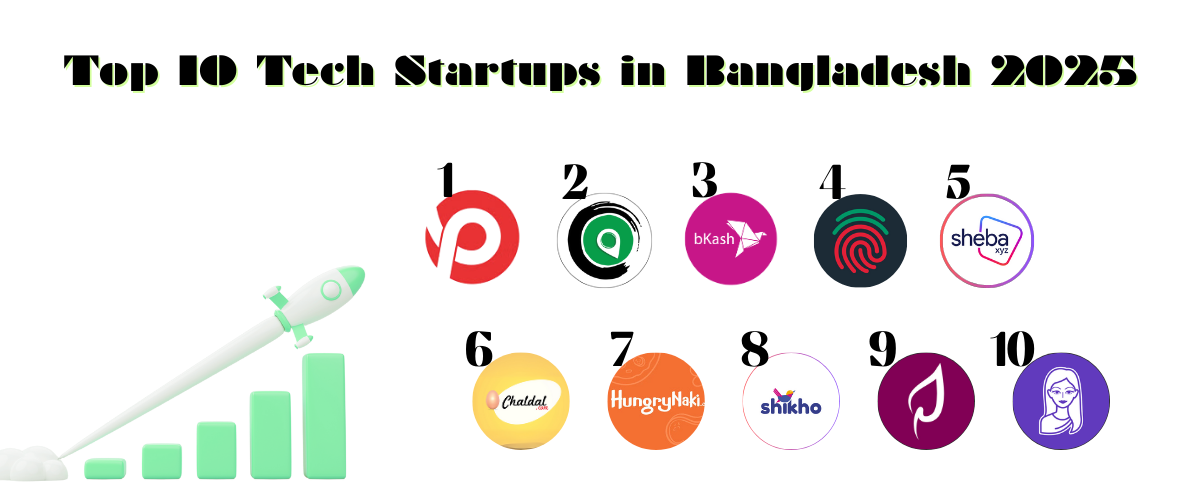

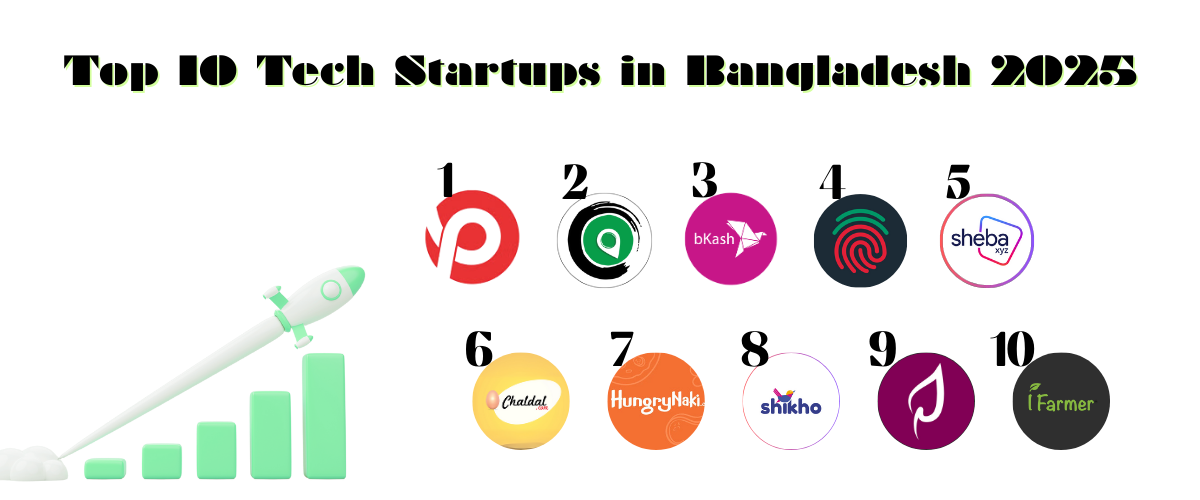

Top 10 Tech Startups in Bangladesh: At a Glance

Research shows that Tech Startups in Bangladesh ecosystem received over $200 million in funding in 2024, with tech startups leading the charge. Additionally, government initiatives like the ICT Division’s startup support programs have created a favorable environment for entrepreneurs.

| Startup | Service |

|---|---|

| Pathao | Logistics infrastructure company, not just ride-sharing |

| Shohoz | Supply-side marketplace development expertise |

| bKash | Financial infrastructure for unbanked populations |

| Chaldal | Cold chain logistics and consumer behavior change |

| Sheba.xyz | Service provider professionalization platform |

| Tipsoi | B2B operational digitization specialist |

| HungryNaki | Restaurant ecosystem integration platform |

| Shikho | Exam-focused personalized learning systems |

| Praava Health | Premium healthcare service standardization |

| iFarmer | Agricultural technology |

Investors are increasingly drawn to Tech Startups in Bangladesh, especially in sectors like fintech and agritech.

1. Pathao

Pathao is one of the most famous Tech Startups in Bangladesh. It offers ride-sharing services. You can book bikes, cars, and cycles. Pathao also delivers food and packages. It started in 2015 and has grown quickly. Tech Startups in Bangladesh are driving economic transformation, with platforms like Pathao solving complex urban challenges. Many people use Pathao every day. Tech Startups in Bangladesh are redefining mobility, with Pathao leading through innovative logistics solutions.

Pathao isn’t just Bangladesh’s most visible startup success—it’s a masterclass in building operational excellence in an environment where traditional business assumptions don’t apply. When Pathao launched in 2015, they weren’t just competing with other ride-sharing apps; they were competing with an entire informal transportation ecosystem that had evolved over decades to handle Dhaka’s unique challenges.

The company’s real innovation wasn’t technological—it was operational. Pathao built a logistics network that could function reliably in a city where traffic patterns change hourly, roads don’t always exist on digital maps, and payment systems need to work for users who may not have traditional bank accounts. This required developing custom solutions for route optimization, driver training, customer support, and payment processing that no international company had ever needed to build. By solving unique urban challenges, Tech Startups in Bangladesh like Pathao are gaining global attention.

What most analyses miss about Pathao’s success is how they solved the trust problem. In a market where personal relationships matter more than digital ratings, Pathao had to build systems that could establish trust between strangers using a mobile app. This involved everything from driver verification processes that work without traditional credit histories to customer service systems that can handle disputes in local languages and cultural contexts. Tech Startups in Bangladesh are leveraging data-driven insights, as seen in Pathao’s route optimization systems.

Pathao’s expansion into food delivery and courier services wasn’t just diversification—it was leveraging the logistics infrastructure they’d already built. Once you’ve solved the problem of reliable delivery in Dhaka traffic, you can apply that capability to moving anything, not just people. This infrastructure-first approach is why Pathao has remained dominant even as international competitors with more funding have entered the market.

The company’s growth trajectory also reveals something important about building startups in emerging markets: sometimes the biggest opportunities come from industries that developed markets consider “solved.” Ride-sharing was already a mature category globally when Pathao launched, but the local execution requirements were so different that it might as well have been a completely new problem. Tech Startups in Bangladesh, such as Pathao, are creating jobs by modernizing transportation infrastructure.

Looking ahead, Pathao’s success will likely depend on their ability to leverage their logistics capabilities into new verticals while maintaining the operational excellence that made them successful. They’ve proven they can move people and packages reliably—the question is what other problems they can solve with that capability.

Venture Capital Landscape

What venture capital opportunities exist in Bangladesh? The venture capital landscape in Bangladesh has expanded significantly, with both local and international investors showing keen interest. Leading venture capital firms operating in Bangladesh include LightCastle Partners, BYESL, and international players like Golden Gate Ventures.

Furthermore, startup funding in Bangladesh reached record highs in 2024, with average seed funding ranging from $50K to $500K, while Series A rounds typically range from $1M to $5M. Tech Startups in Bangladesh are attracting global investors, with companies like Pathao securing significant funding rounds. Research shows that fintech, healthtech, and agritech startups receive the highest funding attention from investors.

Key Takeaway:

- Pathao competed not only with ride-sharing apps but with a deeply entrenched informal transport system.

- Among the most innovative Tech Startups in Bangladesh, Pathao stands out for its logistics solutions tailored to urban challenges.

- Their logistics network was custom-built to handle unpredictable traffic, incomplete digital maps, and users without formal banking access.

- Trust-building was a core challenge; Pathao developed systems for driver verification and customer service that fit local cultural and linguistic contexts.

- Expansion into food delivery and courier services was a strategic move to capitalize on existing logistics infrastructure.

- Their infrastructure-first model enabled resilience against better-funded international competitors.

- Pathao’s journey highlights how “solved” industries in developed markets can present fresh challenges and opportunities in emerging ones.

- Future growth depends on applying their logistics capabilities to new verticals while maintaining their high operational standards.

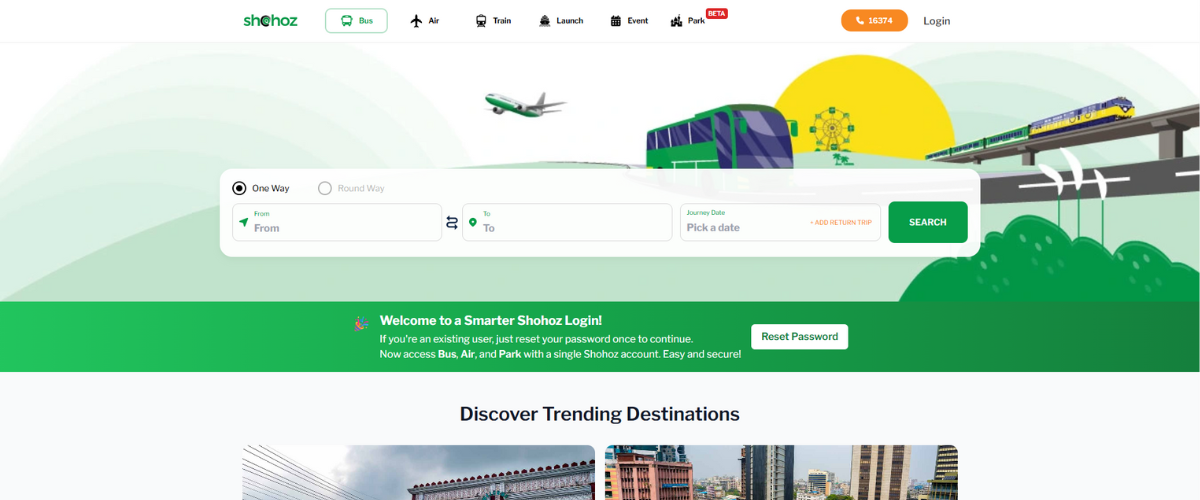

2. Shohoz

Shohoz means “easy” in Bengali. This startup offers ride-sharing services. You can also buy tickets for buses, ferries, and events. Shohoz started in 2014. It aims to make travel simple and easy.

The name “Shohoz” means “easy” in Bengali, and that linguistic choice reveals something crucial about building successful startups in Bangladesh: sometimes the most powerful innovation is making existing processes dramatically simpler. Tech Startups in Bangladesh like Shohoz are simplifying travel and ticketing, contributing to the country’s digital economy. When Shohoz launched in 2013, buying bus tickets, launch tickets, or event tickets in Bangladesh typically involved physically visiting ticket counters, waiting in lines, and hoping your preferred travel times were still available.

Shohoz didn’t invent online ticketing—they adapted it to work in a market where most transportation providers had never used digital systems, most customers had never made online payments, and the entire concept of advance booking was foreign to how people typically planned travel.

The company’s real achievement was building the supply side of their marketplace. This meant not just creating software that transportation providers could use, but actually educating bus operators, launch companies, and event organizers about why digital ticketing would benefit their businesses. Many of these providers had to be convinced that online payments were reliable, that digital tickets could prevent fraud better than paper tickets, and that the convenience for customers would ultimately drive more revenue.

What makes Shohoz particularly interesting as a case study is how they handled the chicken-and-egg problem that kills most marketplace startups. You need supply to attract customers, but you need customers to attract supply. Shohoz solved this by focusing on specific routes and providers where the value proposition was immediately obvious—premium bus services and popular events where advance booking provided clear customer value. With a focus on user convenience, Tech Startups in Bangladesh, including Shohoz, are transforming ticketing systems.

The company’s evolution from pure ticketing platform to broader travel services reflects a common pattern among successful Bangladeshi startups: start with one problem that you can solve completely, then expand into adjacent problems once you’ve built trust and operational capabilities.

Shohoz’s success also demonstrates the importance of timing in emerging markets. They launched just as smartphone adoption was accelerating in Bangladesh, but before the market became crowded with competitors. This timing advantage allowed them to establish relationships with key transportation providers before other companies recognized the opportunity.

From a business model perspective, Shohoz proved that you could build a profitable technology company in Bangladesh by taking small transaction fees from a large volume of transactions. This model works because digital transactions are more efficient for both providers and customers, creating value that can be shared among all participants. The success of Tech Startups in Bangladesh like Shohoz shows the power of localized digital solutions.

Key Takeaway:

- Before Shohoz, ticketing for buses, ferries, and events required physical visits and long waits, with no guarantee of availability.

- They adapted online ticketing to a market unfamiliar with digital systems, online payments, or advance booking.

- Shohoz focused on building the supply side by educating transportation providers on the benefits of digital systems.

- They addressed fraud prevention, payment reliability, and customer convenience to win over skeptical operators.

- Shohoz overcame the marketplace chicken-and-egg dilemma by targeting premium services and high-demand events with clear value propositions.

- Their expansion into broader travel services followed a strategic pattern: solve one problem fully, then grow into adjacent areas.

- Early entry during rising smartphone adoption gave Shohoz a timing advantage over future competitors.

- Their business model, small fees on high transaction volume, proved viable due to the efficiency and value of digital transactions

3. bKash

bKash is a mobile money service. It started in 2011. People can send and receive money using their phones. Many people in Bangladesh use bKash. It is very popular for paying bills and shopping online.

bKash represents perhaps the most transformative technology innovation in Bangladesh’s recent history. The company didn’t just create a mobile payment app—they built financial infrastructure for populations that traditional banking systems couldn’t serve effectively.

When bKash launched in 2011, Bangladesh had one of the world’s largest unbanked populations. Traditional banks struggled to serve rural customers and urban poor because the cost of physical branches and traditional account management made small-balance customers unprofitable. Mobile money services like bKash solved this by leveraging the mobile network infrastructure that already reached these populations. By bridging the unbanked population, Tech Startups in Bangladesh like bKash are driving financial inclusion.

But bKash’s real innovation was understanding that mobile money in Bangladesh couldn’t just replicate banking services on phones—it had to work completely differently. The company built a network of agents (small shops and businesses) that could handle cash-in and cash-out transactions, essentially creating a parallel banking infrastructure that was more accessible than traditional banks.

The agent network model was crucial because it solved the digital-physical interface problem that kills many fintech companies in emerging markets. Tech Startups in Bangladesh are leveraging mobile technology to reach millions, with platforms like bKash driving financial inclusion. Customers could deposit cash at local shops and use mobile money for transactions, then withdraw cash when needed. This hybrid approach made digital payments accessible to users who weren’t ready for fully digital financial services.

What’s particularly remarkable about bKash’s growth is how they achieved scale without sacrificing reliability. Mobile money requires extremely high uptime and transaction success rates because customers lose trust quickly if the service isn’t reliable. Building this reliability in Bangladesh required developing redundant systems, backup communication networks, and fraud prevention capabilities that could work across different technological environments.

bKash’s success also created network effects that made the service more valuable as more people used it. As more merchants accepted bKash payments and more customers used the service, it became increasingly useful for everyone in the network. This created sustainable competitive advantages that are difficult for new entrants to overcome.

The company’s expansion into additional financial services—bill payments, merchant payments, remittances, and lending—demonstrates how mobile money platforms can become comprehensive financial infrastructure. Once you’ve solved the basic problems of digital payments and customer trust, you can offer increasingly sophisticated financial services to the same customer base.

From a broader ecosystem perspective, bKash’s success enabled many other technology companies by providing digital payment infrastructure they could build on. E-commerce companies, ride-sharing apps, and online services all benefited from having a widely-adopted mobile payment system that their customers already understood and trusted.

Key Takeaway:

- bKash built transformative financial infrastructure for underserved populations, not just a mobile payment app.

- It addressed the needs of one of the world’s largest unbanked populations by leveraging widespread mobile networks.

- The agent network model enabled cash-in and cash-out services, creating a parallel banking system accessible to rural and low-income users.

- This hybrid approach bridged the gap between digital and physical transactions, making mobile money viable in Bangladesh.

- bKash prioritized reliability, developing robust systems to ensure high uptime and transaction success across diverse tech environments.

- Network effects strengthened its value as more users and merchants adopted the service, creating barriers for new competitors.

- The company expanded into bill payments, remittances, merchant transactions, and lending, evolving into a full financial ecosystem.

- bKash’s infrastructure empowered other tech startups by providing a trusted digital payment backbone for e-commerce and services.

4. Chaldal

Chaldal is an online grocery store. It started in 2013. You can order groceries from your home. Chaldal delivers to your door. It saves time and is very convenient. Many people in cities use Chaldal.

Chaldal’s success story challenges conventional wisdom about e-commerce in emerging markets. When the company launched in 2013, the prevailing belief was that Bangladeshis would never trust buying fresh groceries online. Traditional shopping culture emphasized personally selecting produce, negotiating prices, and building relationships with vendors—all things that seemed incompatible with e-commerce.

Chaldal proved that with the right execution, you could change deeply ingrained consumer behaviors. But this required solving problems that Amazon or other international e-commerce companies had never faced. The company had to build cold chain logistics in a city where reliable electricity was inconsistent, develop quality guarantee systems that could earn trust from customers who were used to inspecting products before purchase, and create delivery networks that could navigate Dhaka’s notoriously complex addressing system.

The company’s approach to inventory management reveals sophisticated understanding of local market dynamics. Rather than trying to stock everything, Chaldal focused on products where online delivery provided clear advantages over traditional shopping: bulk items that were inconvenient to carry, imported products that were difficult to find in local markets, and perishables where quality control and cold chain management added genuine value.

What’s particularly impressive about Chaldal’s execution is how they handled the trust-building process. Early customers were often skeptical about receiving fresh produce that they hadn’t personally selected. The company addressed this by implementing generous return policies, providing detailed product information and photos, and building customer service systems that could handle complaints and build long-term relationships. Tech Startups in Bangladesh are changing consumer habits, with Chaldal leading the way in online grocery delivery.

Chaldal’s logistics capabilities became increasingly important as the company scaled. Delivering fresh groceries in Dhaka requires route optimization that can handle unpredictable traffic, inventory management that minimizes spoilage, and customer communication systems that can provide real-time delivery updates. These operational capabilities are difficult to replicate and create sustainable competitive advantages. Tech Startups in Bangladesh, such as HungryNaki, are reshaping urban lifestyles by offering reliable food delivery solutions.

The company’s success during the COVID-19 pandemic demonstrated the value of building robust e-commerce infrastructure before it became essential. While other companies struggled to adapt to increased online demand, Chaldal was able to scale their operations to serve customers who suddenly needed grocery delivery services.

From a business model perspective, Chaldal proved that you could build a profitable e-commerce business in Bangladesh by focusing on operational excellence rather than just offering the lowest prices. Customers were willing to pay for convenience, quality, and reliability—but only if those benefits were consistently delivered.

Key Takeaway:

- Chaldal challenged assumptions about e-commerce in Bangladesh by proving consumers could trust online grocery shopping.

- They overcame cultural habits of selecting produce in person and negotiating prices through strong execution and customer-centric policies.

- The company built cold chain logistics and delivery systems tailored to Dhaka’s unreliable infrastructure and complex addressing.

- Inventory strategy focused on bulk items, hard-to-find imports, and perishables where online delivery added clear value.

- Trust was built through generous return policies, detailed product info, and responsive customer service.

- Logistics excellence—route optimization, spoilage control, and real-time updates—became a key competitive advantage.

- Chaldal’s preparedness allowed it to scale effectively during the COVID-19 surge in online demand.

- Their business model prioritized reliability and convenience over price, proving customers would pay for consistent quality.

5. Sheba.xyz

Sheba.xyz is an online service platform. It started in 2015. You can find many services here. For example, cleaning, plumbing, and electrical work. Sheba.xyz connects you with professionals. It makes finding help easy and fast.

Sheba.xyz represents the service marketplace opportunity that emerges in every developing economy, but their execution reveals sophisticated understanding of how to build marketplaces in environments where the supply side needs to be created, not just aggregated.

When Sheba.xyz launched in 2015, Bangladesh had plenty of people providing home services—cleaning, repairs, electrical work, plumbing—but these services were typically found through personal networks and recommendations. There was no reliable way to discover service providers, compare quality and pricing, or ensure accountability for work quality.

The company’s real innovation was understanding that building a service marketplace in Bangladesh couldn’t just connect existing supply with demand—they had to professionalize the supply side. Many of the service providers on Sheba.xyz had never operated formal businesses before. They didn’t have standardized pricing, quality control processes, or customer service systems.

Sheba.xyz addressed this by building not just a platform, but an entire ecosystem of training, certification, and support for service providers. This included everything from basic business training to standardized pricing models to quality control systems that could ensure consistent service delivery across thousands of independent providers.

The platform’s success required solving complex coordination problems. Home services are inherently local and time-sensitive, which means the platform needed to optimize for geographic proximity, availability matching, and real-time scheduling. This required building sophisticated logistics and scheduling systems that could handle the unpredictability of home service delivery. Tech Startups in Bangladesh, such as Sheba.xyz, are creating scalable service marketplaces.” (Note: This overlaps with a prior suggestion but can replace it if preferred.

What’s particularly interesting about Sheba.xyz’s approach is how they handled the trust and safety challenges that are critical for home services. Customers need to feel comfortable letting strangers into their homes, and service providers need protection from unreliable customers. The company built verification systems, insurance coverage, and dispute resolution processes that made the platform safe for both sides. By addressing local challenges, Tech Startups in Bangladesh like Sheba.xyz are creating scalable service marketplaces.

Sheba.xyz’s expansion strategy reveals understanding of how to build sustainable marketplace businesses. Rather than trying to be everything to everyone immediately, they focused on specific service categories where they could build strong supply and demand, then gradually expanded into adjacent services. This approach allowed them to maintain quality control while scaling.

The company’s success also demonstrates the power of building platforms that create economic opportunities for underemployed populations. Many Sheba.xyz service providers were able to build sustainable businesses through the platform, creating economic value that extended beyond just the convenience for customers.

From a technology perspective, Sheba.xyz had to solve complex problems around mobile interfaces for providers who might not be sophisticated smartphone users, payment systems that could handle cash and digital transactions, and customer communication systems that could work across different languages and literacy levels.

Key Takeaway:

- Sheba.xyz built a service marketplace by professionalizing the supply side, not just aggregating existing providers.

- Before Sheba.xyz, home services in Bangladesh were accessed through informal networks with no standardization or accountability.

- The company created an ecosystem of training, certification, and support to elevate service quality and consistency.

- They solved coordination challenges by optimizing for location, availability, and real-time scheduling in a time-sensitive industry.

- Trust and safety were prioritized through verification, insurance, and dispute resolution systems for both customers and providers.

- Their expansion strategy focused on mastering specific service categories before scaling into adjacent ones, ensuring quality control.

- Sheba.xyz empowered underemployed individuals to build sustainable businesses, generating broader economic impact.

- Technological solutions addressed mobile usability, hybrid payment systems, and communication across diverse languages and literacy levels.

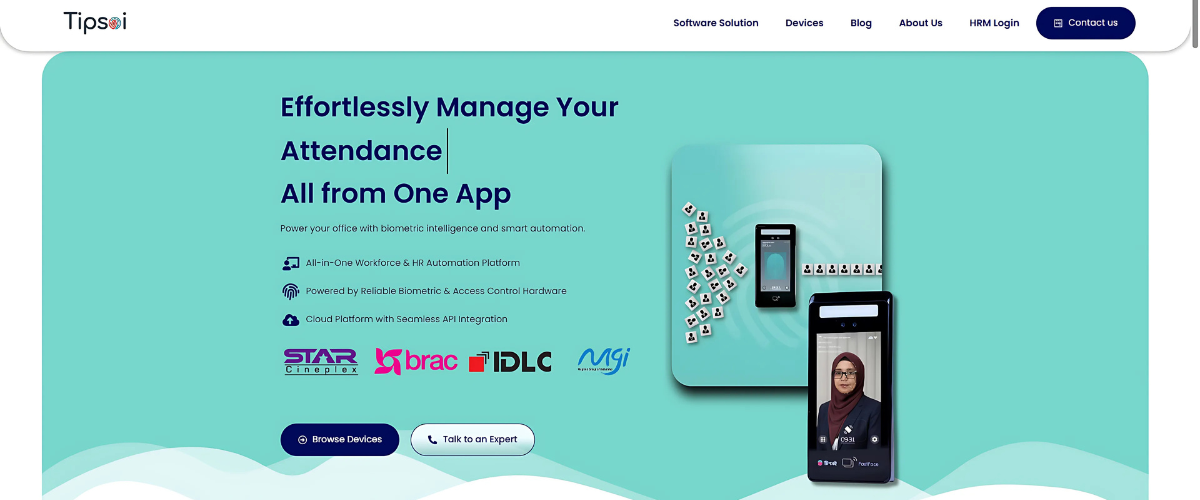

6. Tipsoi

When people think about Bangladesh’s startup success stories, they typically focus on consumer-facing platforms like ride-sharing and food delivery. But some of the most sustainable businesses are being built in the B2B space, solving operational challenges that every organization faces. Tipsoi represents this often-overlooked category of startups that are quietly transforming how businesses and educational institutions operate.

Tipsoi offers cloud-based attendance tracking solutions that combine biometric devices with customized software. While this might sound like a straightforward HR tech play, the reality is more nuanced. In Bangladesh, where traditional attendance tracking often relies on manual processes prone to errors and manipulation, Tipsoi is building the infrastructure that enables organizations to digitize their most basic operational functions.

What makes Tipsoi particularly interesting as a startup case study is their approach to market entry. Rather than trying to compete with international HR software giants on features, they focused on solving a specific, painful problem that every Bangladeshi organization faces: accurate, tamper-proof attendance tracking. This focus on execution over innovation—a pattern we see among successful Bangladeshi startups—has allowed them to build a sustainable business in a market that multinational companies often overlook.

The company’s success also reveals something important about the B2B opportunity in Bangladesh. While consumer startups get most of the attention, there’s a massive market of traditional businesses and educational institutions that need technology solutions but can’t adapt to one-size-fits-all international products. Tipsoi’s approach of offering both hardware (biometric devices) and software (customized applications) addresses the reality that many Bangladeshi organizations need complete solutions, not just software licenses.

This hardware-software integration strategy is particularly smart in the local context. Many organizations don’t have existing digital infrastructure that can easily integrate with cloud-based software. By providing the complete solution—devices, software, and customization—Tipsoi removes the technical barriers that prevent organizations from adopting digital attendance systems. The success of Tech Startups in Bangladesh highlights the importance of localized innovation in emerging markets.

From an ecosystem perspective, Tipsoi represents the kind of B2B startup that Bangladesh needs more of. These companies may not generate the headlines that consumer apps do, but they’re building the operational backbone that helps traditional businesses become more efficient. As more organizations digitize their operations, companies like Tipsoi are positioned to capture significant market share in sectors that international competitors find difficult to penetrate.

The timing is also worth noting. As Bangladesh’s economy grows and labor regulations become more stringent, accurate attendance tracking becomes not just a convenience but a compliance requirement. Organizations need auditable records for labor law compliance, payroll accuracy, and productivity measurement. Tipsoi is building solutions for regulatory requirements that will only become more important over time.

What’s particularly promising about Tipsoi’s approach is their focus on customization. Rather than offering a standard product, they adapt their software to meet specific organizational needs. This flexibility is crucial in the Bangladeshi market, where businesses often have unique operational requirements that off-the-shelf solutions can’t address.

Looking ahead, Tipsoi’s success will likely depend on their ability to expand beyond attendance tracking into broader workforce management solutions. The companies that build strong relationships with organizations through simple, reliable attendance systems are well-positioned to offer additional services like payroll integration, performance tracking, and workforce analytics.

This expansion path—starting with a simple, essential service and gradually adding capabilities—mirrors the growth strategy of many successful Bangladeshi startups. It’s a more sustainable approach than trying to build comprehensive platforms from day one, especially in a market where organizations are still learning to trust cloud-based solutions for critical business functions.

Key Takeaway:

- Tipsoi exemplifies the rise of B2B startups in Bangladesh, focusing on operational efficiency rather than consumer-facing services.

- Their core offering—biometric attendance tracking with customized software—addresses a widespread problem in Bangladeshi organizations.

- Instead of competing on features with global HR tech firms, Tipsoi prioritized solving a local pain point: tamper-proof attendance records.

- The company’s hardware-software integration strategy is tailored for organizations lacking digital infrastructure, offering complete solutions.

- Tipsoi’s market entry reflects a broader trend among Bangladeshi startups: execution-focused, context-aware innovation.

- Their platform helps businesses meet growing compliance needs around labor laws, payroll accuracy, and productivity tracking.

- Customization is a key differentiator, allowing Tipsoi to serve organizations with unique operational requirements.

- Tipsoi’s success highlights the untapped potential of B2B tech in Bangladesh, especially in sectors underserved by global solutions.

- Their future growth likely hinges on expanding into workforce management tools like payroll, performance tracking, and analytics.

- This gradual expansion model—starting with a core service and layering on capabilities—is a proven strategy in Bangladesh’s startup ecosystem.

7. HungryNaki

HungryNaki is a food delivery service. It started in 2013. You can order food from many restaurants. HungryNaki delivers the food to your home. It is very popular in cities. Many people use HungryNaki for quick meals.

HungryNaki’s success in food delivery reveals important lessons about building consumer platforms in markets where existing infrastructure is unreliable. When the company launched in 2013, food delivery in Bangladesh was dominated by individual restaurants with their own delivery systems, or informal networks of delivery personnel who weren’t integrated with digital ordering systems.

The company’s real achievement was building a logistics network that could reliably deliver food in a city where traditional addressing systems are inconsistent, traffic patterns are unpredictable, and payment systems need to accommodate both cash and digital transactions.

What’s particularly impressive about HungryNaki’s execution is how they built relationships with local restaurants. Many restaurant owners were skeptical about digital ordering systems and commission-based revenue sharing. The company had to demonstrate that online orders would increase overall revenue, not just shift existing orders to a more expensive channel. The rapid growth of Tech Startups in Bangladesh reflects the country’s increasing internet penetration and young demographic.

HungryNaki’s approach to quality control reveals sophisticated understanding of consumer expectations in Bangladesh. Food delivery customers expect not just convenience, but also assurance that food quality and safety will be maintained during delivery. This required building systems for restaurant verification, delivery time optimization, and customer feedback that could maintain quality standards across hundreds of restaurant partners.

The company’s success during peak demand periods—especially during events like cricket matches or political situations when people prefer staying home—demonstrated the value of building scalable logistics infrastructure. Being able to handle sudden spikes in demand without service degradation requires sophisticated capacity planning and resource allocation.

From a competitive perspective, HungryNaki succeeded by focusing on execution excellence rather than trying to compete purely on price or selection. While other platforms might offer more restaurants or lower delivery fees, HungryNaki built a reputation for reliability that created customer loyalty.

The company’s expansion into grocery delivery and other services follows the common pattern among successful Bangladeshi startups of leveraging logistics capabilities into adjacent markets. Once you’ve solved the problem of reliable delivery in urban Bangladesh, you can apply that infrastructure to delivering many different types of products.

HungryNaki’s technology platform had to solve complex problems around real-time order tracking, dynamic pricing for delivery fees, and integration with restaurant point-of-sale systems that might not be digitally sophisticated. These technical challenges required building custom solutions that international food delivery platforms hadn’t needed to develop.

Key Takeaway:

- HungryNaki built a reliable food delivery network in Bangladesh despite challenges like inconsistent addresses, unpredictable traffic, and mixed payment preferences.

- At launch, food delivery was fragmented, relying on individual restaurants or informal networks without digital integration.

- The company earned restaurant trust by proving that digital orders could grow revenue, not just shift existing demand.

- Quality control systems ensured food safety and delivery standards, addressing local consumer expectations.

- Scalable logistics allowed HungryNaki to handle peak demand during major events without service breakdowns.

- Execution excellence, not price or selection, drove customer loyalty and differentiated HungryNaki from competitors.

- Expansion into grocery and other services leveraged their core logistics infrastructure for broader market reach.

- Their tech platform tackled real-time tracking, dynamic pricing, and integration with low-tech restaurant systems through custom-built solutions.

8. Shikho

Shikho is an online learning platform. It started in 2019. Students can find courses and study materials. Shikho helps students prepare for exams. It is very useful for school and college students.

Shikho represents the massive opportunity in educational technology in Bangladesh, but their approach reveals how edtech startups need to understand local educational culture and exam systems to be successful. When Shikho launched in 2019, they entered a market where traditional education was heavily focused on exam preparation, rote learning, and competition for limited spots in prestigious institutions.

The company’s success comes from understanding that edtech in Bangladesh can’t just provide content—it needs to provide structured learning paths that align with local curriculum standards, exam formats, and academic expectations. This meant building not just video lessons, but comprehensive study systems that could help students prepare for specific exams like HSC, SSC, and university admission tests.

What makes Shikho particularly effective is their approach to personalized learning. Rather than offering one-size-fits-all content, the platform adapts to individual student performance and learning pace. This is crucial in Bangladesh’s competitive academic environment, where students need to excel in specific subjects to achieve their educational goals.

The company’s mobile-first strategy was essential for reaching their target audience. Many students in Bangladesh access educational content primarily through smartphones, and internet connectivity can be inconsistent. Shikho built their platform to work effectively on lower-end devices and intermittent connections. The rise of Tech Startups in Bangladesh in edtech, like 10 Minute School, is bridging educational gaps for students nationwide.

Shikho’s content strategy reveals deep understanding of how students actually learn. Rather than just providing lectures, the platform includes practice tests, interactive exercises, and progress tracking that help students identify knowledge gaps and focus their study time effectively.

From a business model perspective, Shikho had to balance affordability with quality. Educational content needs to be accessible to students from different economic backgrounds, but creating high-quality educational materials requires significant investment. The company developed subscription models and pricing tiers that could serve different market segments.

The platform’s success during the COVID-19 pandemic, when traditional schools were closed, demonstrated the value of having robust online learning infrastructure already in place. While other educational institutions struggled to move online, Shikho was able to scale their services to serve students who suddenly needed remote learning solutions.

Shikho’s approach to teacher training and content creation reveals how edtech companies can work with rather than against traditional educational systems. Edtech innovations from Tech Startups in Bangladesh, including Shikho, are helping students prepare for competitive exams. Rather than trying to replace teachers, the platform provides tools that help teachers deliver better educational outcomes for their students.

Key Takeaway:

- Shikho tapped into Bangladesh’s exam-driven education culture by aligning its content with local curricula and test formats.

- The platform offers structured learning paths for key exams like HSC, SSC, and university admissions, not just generic content.

- Personalized learning adapts to each student’s pace and performance, crucial in a highly competitive academic environment.

- A mobile-first design ensures accessibility on low-end devices and unstable internet, matching student realities.

- Shikho’s content includes interactive exercises, practice tests, and progress tracking to reinforce learning and identify gaps.

- Their pricing strategy balances affordability with quality, using tiered subscriptions to reach diverse economic groups.

- During COVID-19, Shikho scaled quickly to meet remote learning needs, proving the strength of its infrastructure.

- The platform supports teachers with tools and training, enhancing traditional education rather than replacing it.

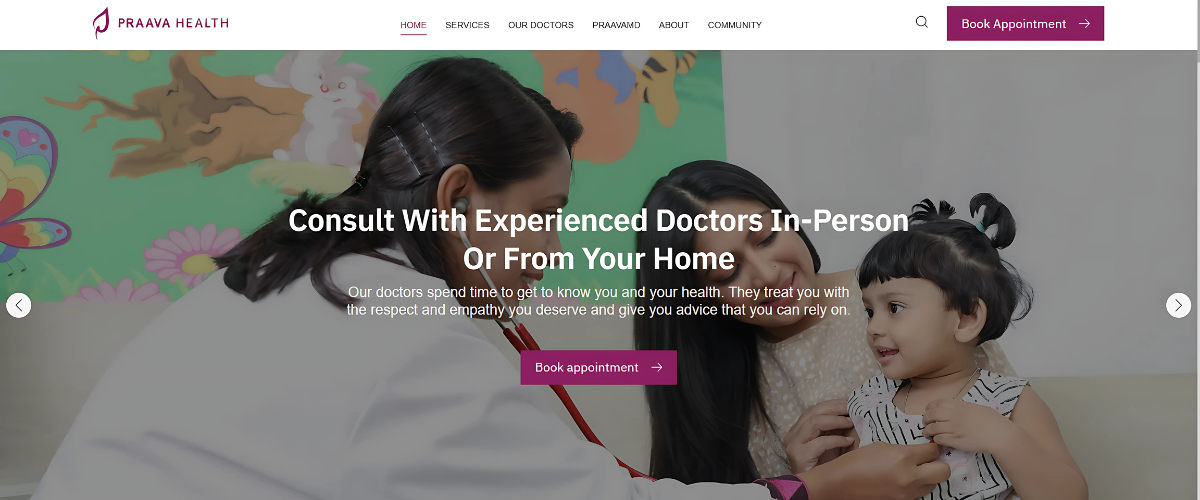

9. Praava Health

Praava Health is a healthcare startup. It started in 2017. Praava Health offers medical services. You can see doctors and get tests done. Praava Health also has a mobile app. It makes booking appointments easy.

Praava Health represents a different approach to healthcare technology in Bangladesh—focusing on premium healthcare services delivered through technology rather than making basic healthcare more accessible. When Praava launched in 2017, they targeted urban professionals who were willing to pay for convenience, quality, and reliability in healthcare services.

The company’s strategy was to build a healthcare experience that matched international standards while being accessible in Bangladesh. This meant not just providing telemedicine consultations, but creating integrated healthcare services that could include everything from online consultations to in-person visits to diagnostic services.

What makes Praava’s execution particularly sophisticated is how they built trust with customers who had options to seek healthcare internationally. The company had to demonstrate that they could provide healthcare services that were genuinely comparable to what customers might receive in Singapore, Thailand, or India.

Praava’s technology platform needed to handle complex problems around medical records management, prescription systems, and integration with diagnostic labs and pharmacies. This required building healthcare technology infrastructure that could meet regulatory requirements while providing seamless user experiences. Tech Startups in Bangladesh, including Praava Health, are transforming healthcare access with technology-driven services.

The company’s approach to doctor recruitment and training reveals understanding of how to build premium healthcare services in a market where top medical talent often seeks opportunities abroad. Praava created working environments and compensation packages that could retain high-quality healthcare professionals in Bangladesh.

From a business model perspective, Praava proved that there was demand for premium healthcare services in Bangladesh, even at price points significantly higher than traditional healthcare options. This demonstrated that a segment of the market was willing to pay for quality and convenience.

Praava’s success during the COVID-19 pandemic showed the value of having robust telemedicine infrastructure already in place. While traditional healthcare providers struggled to maintain services during lockdowns, Praava could continue providing consultations and coordinating care through digital channels.

The company’s expansion into corporate healthcare services reveals how healthcare technology companies can build sustainable revenue streams by serving business customers as well as individual consumers. Corporate health benefits represent a growing market opportunity as Bangladesh’s economy develops.

Key Takeaway:

- Praava Health focused on premium healthcare for urban professionals, emphasizing convenience, quality, and reliability.

- Their strategy combined telemedicine, in-person visits, and diagnostics to deliver integrated healthcare experiences.

- To gain trust, Praava positioned itself as comparable to international healthcare providers in Singapore, Thailand, and India.

- Their tech platform tackled challenges in medical records, prescriptions, and integration with labs and pharmacies, meeting regulatory standards.

- Praava retained top medical talent by offering competitive compensation and professional environments, countering brain drain.

- They validated demand for high-end healthcare services in Bangladesh, even at higher price points than traditional providers.

- During COVID-19, Praava’s telemedicine infrastructure enabled uninterrupted care while others struggled to adapt.

- Expansion into corporate healthcare services opened new revenue streams, aligning with Bangladesh’s economic growth.

10. iFarmer

iFarmer represents the agricultural technology revolution that’s quietly transforming Bangladesh’s largest economic sector. When iFarmer launched in 2017, they entered a market where traditional farming practices dominated, access to financing was limited, and technology adoption was minimal. Agriculture employs nearly 40% of Bangladesh’s workforce, but productivity remained constrained by outdated methods and lack of capital.

The company’s approach to agritech reveals sophisticated understanding of how to build technology solutions for traditional industries. Rather than trying to replace existing farming practices entirely, iFarmer created a platform that enhances what farmers already do well while solving their most pressing problems: access to financing, quality inputs, and reliable markets for their produce.

What makes iFarmer particularly innovative is their integrated approach to agricultural financing. Traditional banks struggle to serve farmers because agricultural income is seasonal, collateral requirements are difficult to meet, and risk assessment is complex. iFarmer solved this by creating alternative credit scoring systems based on farming data, crop cycles, and historical productivity rather than traditional financial metrics.

The company’s technology platform addresses multiple pain points in the agricultural value chain. Farmers can access financing for seeds, fertilizers, and equipment through the app, receive expert agricultural advice, track crop performance, and connect directly with buyers. This end-to-end approach creates value for all participants in the agricultural ecosystem.

iFarmer’s success required building trust with rural farming communities who were often skeptical of technology-based solutions. This involved extensive field work, training programs for farmers, and demonstrating tangible benefits through pilot projects. Tech Startups in Bangladesh are pioneering sustainable solutions, with iFarmer enhancing agricultural productivity through data analytics. The company had to prove that their platform could increase yields and income, not just digitize existing processes.

The timing of iFarmer’s growth aligns with broader trends in Bangladesh’s agricultural sector. Climate change is making traditional farming methods less reliable, younger farmers are more open to technology adoption, and government initiatives are promoting agricultural modernization. iFarmer positioned themselves to benefit from all these trends.

From a business model perspective, iFarmer generates revenue through multiple channels: transaction fees on financing, commissions on input sales, and platform fees for connecting farmers with buyers. This diversified approach creates multiple revenue streams while ensuring the platform remains valuable for all participants.

What’s particularly promising about iFarmer’s approach is their use of data analytics to improve agricultural outcomes. By collecting data on farming practices, weather patterns, soil conditions, and crop performance, they can provide increasingly sophisticated advice to farmers and better risk assessment for financing decisions.

The company’s expansion strategy reveals understanding of how to scale agritech solutions. Rather than trying to serve all farmers immediately, they focused on specific crops and regions where their value proposition was strongest, then gradually expanded to new areas and agricultural products.

iFarmer’s success also demonstrates the potential for technology to address some of Bangladesh’s most fundamental economic challenges. By improving agricultural productivity and creating better market access for farmers, they’re contributing to rural economic development and food security.

Key Takeaway:

- iFarmer enhances traditional farming practices rather than replacing them

- Provides farmers with access to financing, quality inputs, expert advice, and direct market connections

- Uses alternative credit scoring based on farming data and crop cycles instead of traditional financial metrics

- Builds trust with rural communities through fieldwork, training, and pilot projects

- Leverages data analytics to improve crop yields, risk assessment, and farming decisions

- Aligns with broader trends like climate change adaptation, youth tech adoption, and government modernization efforts

- Generates revenue through financing transaction fees, input sales commissions, and platform usage fees

- Scales strategically by focusing on specific crops and regions before expanding

- Contributes to rural economic development and national food security through improved agricultural productivity

What These Success Stories Really Tell Us

These ten companies didn’t succeed because of the ecosystem, they succeeded despite it. The success stories of Tech Startups in Bangladesh demonstrate the potential for emerging markets to foster global-scale innovation. Each one had to solve fundamental infrastructure problems, build trust in markets skeptical of new technology, and navigate regulatory environments that weren’t designed for technology companies.

The common patterns among all these success stories reveal important lessons about building startups in emerging markets: focus on execution over innovation, solve real problems rather than creating new needs, build operational capabilities that are difficult to replicate, and understand that success in Bangladesh requires different strategies than success in Silicon Valley.

Most importantly, these companies prove that Bangladesh can produce technology companies that serve millions of users, generate significant revenue, and create genuine economic value. The question now is whether we can build an ecosystem that makes it easier for the next generation of entrepreneurs to achieve similar success.

What types of tech startups are leading Bangladesh’s innovation?

What types of tech startups are leading Bangladesh’s innovation? The startup landscape spans multiple high-growth sectors:

AI & Technology Startups Bangladesh’s AI startup scene is rapidly expanding with companies like Gaze.ai and Intelligent Machines working on computer vision and machine learning solutions. Additionally, these AI startups in Bangladesh are focusing on solving local problems through artificial intelligence.

Agritech Revolution How are agritech startups transforming Bangladesh agriculture? Companies like iFarmer and AgroShift are digitizing farming practices, connecting farmers with resources, and improving crop yields through technology. Research shows that agritech startups in Bangladesh have increased farmer incomes by 30% on average. With over $1 billion in total funding raised, Tech Startups in Bangladesh are proving their global competitiveness.

Healthcare Innovation Healthcare startups in Bangladesh, including Praava Health and Maya, are making quality healthcare accessible through telemedicine and digital health platforms. Furthermore, these healthtech companies serve over 2 million users across the country.

How can you get startup funding in Bangladesh?

The funding ecosystem includes multiple pathways:

Government Support: Startup Bangladesh Limited, under the ICT Division, provides seed funding ranging from 5 lakh to 1 crore taka. Additionally, the government offers tax incentives and incubation support. The ecosystem for Tech Startups in Bangladesh is supported by government initiatives like Startup Bangladesh.

Angel Investors: The country hosts active angel investor networks including Bangladesh Angels and Dhaka Angels, with individual investments typically ranging from $10K to $100K.

Venture Capital: International and local VC firms have invested over $500 million cumulatively in Bangladeshi startups since 2015, with fintech and mobility receiving the largest share.

Which startups are experiencing the fastest growth in Bangladesh?

The fastest-growing businesses in Bangladesh include:

- Pathao: Now valued at over $100 million with 5 million+ users

- bKash: Processing over $2 billion in monthly transactions

- Chaldal: Serving 50,000+ orders monthly across major cities

🇧🇩 Bangladesh Startup Ecosystem Map 2025

A comprehensive view of Bangladesh’s thriving innovation landscape

1,200+

Active Startups

$1B+

Total Funding Raised

1.5M+

Jobs Created

$119.9M

H1 2025 Funding

📊 Top Sectors by Funding

🗺️ Geographic Distribution

💰 Annual Funding Trends (2020-2025)

🚀 Major Startups by Sector

Research shows that successful startups in Bangladesh typically achieve 200%+ year-over-year growth in their first three years. Furthermore, these companies collectively employ over 50,000+ people directly and indirectly.

How to Start a Startup in Bangladesh

How do you start a successful tech startup in Bangladesh? The startup process involves several key steps:

Legal Formation: Register your company with RJSC (Registrar of Joint Stock Companies and Firms), which typically takes 15-30 days. Additionally, obtain necessary licenses based on your business model.

Funding Strategy: Start with personal savings or friends/family funding, then approach angel investors or participate in startup competitions. Research shows that 70% of successful Bangladesh startups begin with under $10,000 in initial capital.Market Validation: Test your product with local users, gather feedback, and iterate quickly. Furthermore, focus on solving genuine local problems rather than copying international models. By leveraging technology, Tech Startups in Bangladesh are transforming traditional industries.

Why These Startups Matter

These startups are important for Bangladesh. They solve everyday problems. They make life easier for many people. They also create jobs. Many people work for these startups. This helps the economy grow.

Innovation and Technology

These startups use new technology. They offer smart solutions. This helps people save time. It also makes services better. For example, you can book a ride or order food with a few clicks. You can find help for home repairs online. This is very convenient.

Supporting Local Businesses

These startups support local businesses. They connect customers with local services. This helps small businesses grow. It also helps the community. When you use these startups, you support local workers.

Frequently Asked Questions

What are the most promising startup opportunities in Bangladesh 2025?

The most promising opportunities include fintech solutions for the unbanked population, agritech platforms for smallholder farmers, and healthtech services for rural areas. Research shows these sectors have the highest growth potential and investor interest. Agritech solutions by Tech Startups in Bangladesh like iFarmer are transforming farming and boosting rural economies.

Which venture capital firms are actively investing in Bangladesh?

Active VC firms include LightCastle Partners, BYESL, Golden Gate Ventures, and Shorooq Partners. Additionally, international funds like 500 Startups and Seedstars have shown interest in the Bangladesh market.

How much funding do Bangladesh startups typically raise?

Seed rounds typically range from $50K-$500K, Series A from $1M-$5M, and later stages can reach $10M+. Furthermore, the average time between funding rounds is 18-24 months for successful startups.

What makes Bangladesh’s startup ecosystem unique?

Bangladesh offers a large domestic market of 170 million people, low operational costs, and strong government support through ICT Division initiatives. Additionally, the country’s young demographic and increasing internet penetration create ideal conditions for tech startups.

Are there unicorn startups in Bangladesh?

Currently, Bangladesh doesn’t have any official unicorn startups (valued at $1 billion+), but companies like Pathao and bKash are considered potential unicorn candidates with their rapid growth trajectories.

What Are The Top Tech Startups In Bangladesh?

The top tech startups in Bangladesh include Pathao, Chaldal, Shohoz, and 10 Minute School.

How Is Pathao Contributing To The Tech Scene?

Pathao offers ride-sharing, food delivery, and courier services. They are a leading tech company in Bangladesh.

Why Is Chaldal Popular In Bangladesh?

Chaldal is popular because it delivers groceries quickly. They use technology to make shopping easy and convenient.

What Services Does Shohoz Provide?

Shohoz provides ticket booking, ride-sharing, and food delivery services. They are a versatile tech startup.

What statistics define Bangladesh’s startup success?

Here are key data points that showcase the ecosystem’s growth:

- Total Active Startups: 1,200+ (as of 2025)

- Average Employee Growth: 150% annually for top performers

- Sector Distribution: 35% Fintech, 25% E-commerce, 20% Healthtech, 20% Other

- Female Founder Percentage: 22% (growing from 15% in 2020)

Average Time to Market: 8-12 months for MVP development

Conclusion

Tech startups in Bangladesh are making a big impact. They solve problems and make life easier. They use technology to offer smart solutions. These startups also create jobs and support local businesses. The ecosystem for Tech Startups in Bangladesh is evolving rapidly, with more than 1,200 active companies by 2025. The future looks bright for tech startups in Bangladesh. The ecosystem for Tech Startups in Bangladesh is bolstered by government initiatives like Startup Bangladesh Limited.